Medicare

New to Medicare?

New to Medicare?

Medicare can be confusing. There are so many details, enrollment periods (IEP and AEP), late enrollment penalties and then there are the Parts (Part A, Part B, Part C, and Part D) - how do you keep it all straight? Which Medicare Plan do you choose? What are all of your options? Let Safeguard Benefit Services be your professional guide. We will guide you down the Medicare path so that you can make an informed decision and ensure that you are getting all of the benefits that you are entitled to receive.

In this guide we will talk about:

First, we will talk about the two main Enrollment Periods - IEP and AEP.

Enrollment Periods - IEP and AEP

Enrollment Periods

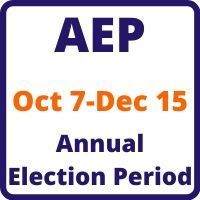

There are two main enrollment periods that we will go over with you - Initial Enrollment Period (IEP) and Annual Enrollment Period (AEP).

The Initial Enrollment Period (IEP) is the 7 month period that starts 3 months before your 65th birth month, lasts the month your turn 65, and ends 3 months after you turn 65. For many folks, this is the period of time that you will apply for Medicare for the first time. This is also the time that most folks pick a Medicare Advantage Plan (Part C) or a Medicare Supplement and Prescription Drug Plan (Part D). There are certain circumstances where you may be eligible for Medicare prior to turning 65. Call us today if you need assistance navigating the Enrollment Periods.

The Annual Enrollment Period (AEP) happens every year and starts on October 7th and ends on December 15th. This is the time of year that you can make a change to your Medicare Advantage Plan (Part C) or your Prescription Drug Plan (Part D). If you have a Medicare Supplement, you can switch to another Medicare Supplement at any time of the year although you may be subject to medical underwriting. If you ever want to review your options or are wondering if you are missing out on benefits, make sure and contact us during AEP.

Next, we will discuss the ABC's or Parts of Medicare, beginning with Part A (Hospital).

ABC's of Medicare - Part A (Hospital) Coverage

Part A (Hospital) Coverage

Medicare Part A helps to cover:

- Inpatient hospital care

- Skilled nursing facilities

- Hospice care

- Home health care

If you have worked and paid income taxes for at least 40 quarters or 10 years, then you will receive Part A without a premium. In 2020, the Medicare Part A deductible was $1,408 - a $44 increase from the previous year. In 2019, the deductible was $1,364.

Next, we will continue with the ABC's or Parts of Medicare, moving to Part B (Medical).

ABC's of Medicare - Part B (Medical) Coverage

Part B (Medical) Coverage

Medicare Part B helps to cover:

- Doctor's services

- Outpatient procedures

- Home health care

- Durable Medical Equipment (DME) - walkers, wheelchairs, etc.

In 2020 your monthly Part B premium will be $144.60 if your Modified Adjusted Gross Income (MAGI) in 2018 was $87,000 or less (filed as individual or married filed separately) or $174,000 or less (filed jointly). If you make more than these limits, your Part B premium will be higher. The $144.60 premium is a $9.10 increase from the 2019 Part B premium ($135.50). There is also a Part B deductible of $198 per calendar year, an increase of $13 from the 2019 Part B deductible ($185).

Next, we will continue with the ABC's or Parts of Medicare, moving to Part D (Prescription Drug Plans).

ABC's of Medicare - Part D (Prescription Drug Plans)

Part D (Prescription Drug Plans)

Part D Prescription Drug Plans help to cover drugs prescribed by your physician. It's important to review your drug plan periodically to make sure that you are getting the best value. Your out of pocket cost are determined by a few different variables:

- Is your prescription covered under your Part D drug plan's formula?

- What formulary tier is your prescription covered at?

- What copays are involved when filling your prescriptions?

- Is there a deductible that you have to pay before your Part D coverage picks up?

Safeguard Benefits Services has a proprietary software that will review your medication list and cross-reference all of the drug plans in your county to ensure that:

- You are maximizing your formulary coverage

- You are minimizing your out of pocket costs such as copays and deductibles

Call us today to make sure you aren't missing out on Part D drug plan savings.

Next, we will continue with the ABC's or Parts of Medicare, moving to Part C (Medicare Advantage Plans).

ABC's of Medicare - Part C (Medicare Advantage Plans)

Part C (Medicare Advantage Plans)

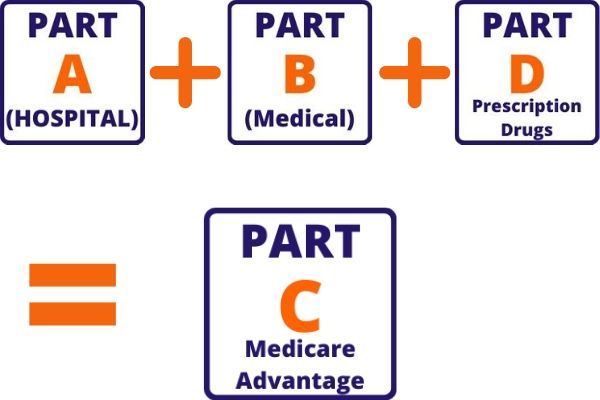

Medicare Part C is also referred to as Medicare Advantage. Think of Medicare Advantage Plans as your combination or "combo" Plans. Medicare Advantage combines your Part A (Hospital), Part B (Medical), and Part D (Prescription Drug Plan) all into one single Medicare Advantage Plan.

Medicare Advantage Plans

may contain additional coverage and benefits that are not included with Original Medicare or a Medicare Supplement such as:

- Dental Coverage

- Vision Coverage

- Transportation for Medical

- Over the Counter Catalog

- Gym/Fitness Memberships

Some plans are available with $0 monthly premium, $0 copay, and $0 deductibles. To find out more about Medicare Advantage Plans CLICK HERE.

That completes the ABC's of Medicare, next we will talk about Original Medicare.

Interested in hearing more about Medicare Advantage Plans in your county? Complete the form below and we will contact you as soon as possible.

Thank you for contacting us.

We will get back to you as soon as possible.

We will get back to you as soon as possible.

Oops, there was an error sending your message.

Please try again later.

Please try again later.

By submitting your information you acknowledge that an insurance agent with Safeguard Benefit Services may contact you by phone, SMS, email, or mail to discuss and quote Medicare Advantage plans, Medicare Supplement Insurance, or Prescription Drug Plans. To Unsubscribe from messaging reply STOP.

Original Medicare

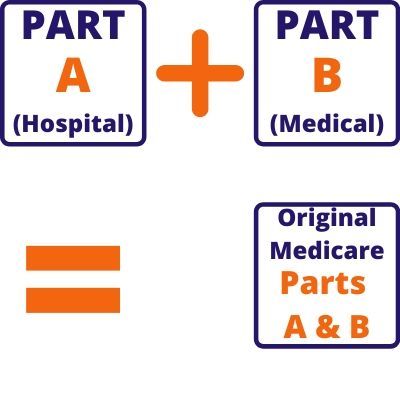

Original Medicare

Original Medicare is composed of your Part A (Hospital) and Part B (Medical) coverage. A recent study showed that approximately 96% of all doctors and hospitals accept Original Medicare. This means that you are not restricted to networks and have the freedom to choose your providers. There is a cost associated to that freedom - Original Medicare only pays 80% of a Part B charge, leaving you to pay the remaining 20%. There is also the Part A hospitalization deductible of $1,408 that you will have to pay out of pocket in the event of a hospitalization. If you choose Original Medicare you will either have to pick up a Part D Prescription Drug Plan or you will have to have some other form of creditable drug coverage in place to avoid the Part D late enrollment penalty.

What options do you have if you don't like the Part A and Part B out of pocket exposure with Original Medicare? You've got a couple choices - you can either add a Medicare Supplement on top of your Original Medicare or you can enroll in a Medicare Advantage (Part C) Plan.

Next up Medicare Supplements.

Medicare Supplements

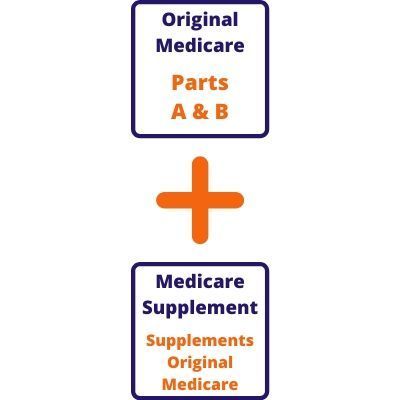

Medicare Supplements

Medicare Supplements, also known as MediGap, can take care of some of the out of pocket exposures that you have with Original Medicare. There are Medicare Supplements available, for an additional monthly premium, that will take care of the Part B 20% that Original Medicare doesn't pay and the Part A Hospital deductible. To learn more about Medicare Supplements available in your area CLICK HERE.

With a Medicare Supplement you still have the freedom to access any doctor or hospital that accepts Original Medicare. All Medicare Supplements are standardized which means the only major difference between two Plans with the same letter code (F, G, N, etc.) provide the same exact coverages, the only difference is the monthly premium that you pay each month.

Interested in hearing more about Medicare Supplement Plans in your county? Complete the form below and we will contact you as soon as possible.

Thank you for contacting us.

We will get back to you as soon as possible.

We will get back to you as soon as possible.

Oops, there was an error sending your message.

Please try again later.

Please try again later.

© 2024

All Rights Reserved | Safeguard Benefit Services & Safeguard Insurance and Financial Services, Inc.